How much does it cost to open a Lightning channel?

The concept of “cost“ when applied to opening a Lightning channel is not straightforward, but it is also imperative that you understand it.

The only cost are fees

Intuitively, you might guess that opening a BIG channel -- say, 1 BTC -- would cost more than opening a SMALL channel -- say, 0.05 BTC.

This is not the case. A big channel will tie up more of your BTC, but otherwise, there is no difference in cost.

In the beginning of Bitcoin -- roughly until around 2017 -- fees on Bitcoin were not much of an issue. There was so little transaction volume that there was rarely competition for space in the blocks.

That's not the case now, and sometimes fees can be high.

Understanding fees

A channel opening transaction is a transaction like any other on the Bitcoin blockchain. In order to convince a miner to include your transaction in a Bitcoin block, you need to offer fees.

Fees these days are typically measured in sat per vB.

sat are Satoshis. There are 100,000,000 satoshis in a Bitoin.

A vB is a way of measuring the number of bytes in a transaction. The more bytes, the more data has to be written to the block.

Like the weather, Bitcoin fees can vary in surprising and unpredictable ways.

Ideally, you will open (and close) channels during times of low fees, and avoid periods of high fees.

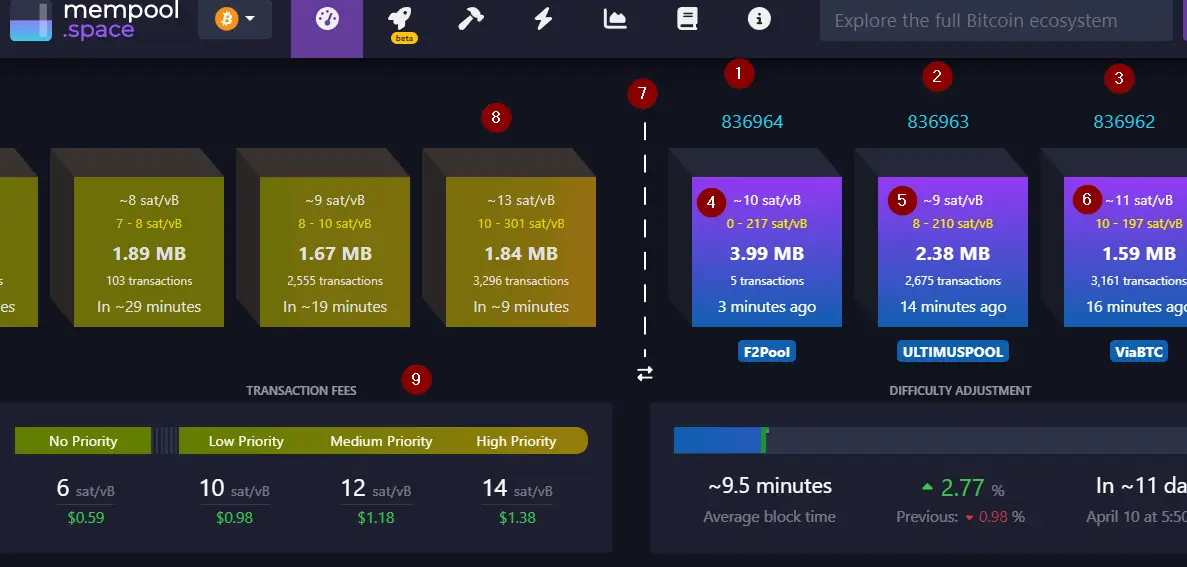

Let's look at fees explorer, like this: https://mempool.space/

- Most recent confirmed block.

- 2nd most recent confirmed block.

- 3rd most recent confirmed block.

- Transactions offering fees at or above

10 sat/vBwere accepted into this block. - Transactions offering fees at or above

9 sat/vBwere accepted into this block. - Transactions offering fees at or above

11 sat/vBwere accepted into this block. - Left of this lines are new blocks.

- This website is predicting that to get a transaction into the next block a fee at or above

13 sat/vBwill be necessary. - If you want to get a transaction into the next block "for sure", you should offer

14 sat/vB. If you're willing to wait a few blocks, you could offer as low as10 sat/vB

LND will always estimate fees for you

So, this fees thing seems complicated, right?

It's actually not that bad.

Like other wallets, LND's wallet will estimate fees for you, so when you open or close a channel, you don't have to choose a fee rate.

And it's good to understand how this works. You might remember that we populated a configuration file, namely lnd.conf, which you copied from here: https://github.com/MegalithicBTC/LND-With-Docker/blob/master/lnd/COPY-THIS-lnd.conf

This file contains this line:

feeurl=https://bitcoinchainfees.strike.me/v1/fee-estimates

So go ahead and visit this URL in your web browser.

You'll see data like this:

"fee_by_block_target": {

"1": 13000,

"3": 11000,

"6": 10000,

"25": 9663,

"144": 8292,

"288": 8010,

"432": 7517,

"504": 7515

}

If you look at that for a second, you can see that is offering some guesses at recommended fee rates.

Let me put the above data in English.

If you want your transaction to confirm in one block, offer a fee of

13.

If you want your transaction to confirm on three blocks, offer a fee of

11.

If you want your transaction to confirm on three blocks, offer a fee of

10.

LND will choose a reasonable value from this list, and use it when calculating fees.

LND's configuration file allows you to specify this feeurl because there are multiple services offering "fee prediction" services like this, and you could also make your own, if you wanted to.

However, this "fee prediction" thing is something like an unsolved scientific problem. Services like bitcoinchainfees.strike.me work well 95% of the time, but still, unexpected things can happen, for example, fees might suddenly increase in a block, without much notice.

Bitcoin fees are like the weather��

The Bitcoin fee market is like the weather.

Sometimes fees are high, and it's like the wind is blowing strong. It's expensive to open and close channels.

Sometimes fees are low, and it's like there is no wind at all. It's cheap to open and close channels.

And there are sometimes "fee storms", when the wind starts blowing extremely strong, and it suddenly is very expensive to open and close channels.

These "fee storms" be triggered by various events, for example, a big & organized minting of an NFT on the Bitcoin blockchain, or a large exchange consolidating UTXOs. During one of these storms, fees can be suddenly very high, like a big wind coming from nowhere.

Sometimes the "fee storms" can be predicted, but usually they cannot.

And, like the weather, it's easier to predict "fee storms" a few hours into the future. But to try to predict them multiple days in the future: Nearly impossible.

If you run a node for a while and regularly open and close channels, you will find yourself waking up in the morning, and instinctively, without thinking about it, just casually check the "weather" -- that is, the current fees on a fee explorer like mempool.space.

When this happens to you, you'll realize you are like a fisherman looking out over the morning sunrise, to get a sense of the day's weather to come. It’s pretty spiritual, actually.

But wait, you never told me how much it costs to open a channel!?

Sorry about that. I didn't tell you, because I can't tell you. A channel's opening and closing fee is influenced by all of these factors:

- The number of input transactions

- The format of the input transactions (

p2wkh,p2tr,np2wkh) - The current fee rate

And, if, like most of us, you still "think in fiat" (Like, 'how many dollars is this?'), that adds another one:

- Current BTC/Fiat exchange rate

So, the most important thing is to understand everything on this page, and then try opening a channel yourself, and you will quickly find that you get a "feel" for the Bitcoin fee market, just as you might the weather.