The Problem With Altcoins

We've seen that there are serious problems with credit cards. We've seen that Bitcoin solves some of these issues.

But we've also seen that Bitcoin has some major problems: It's too slow, and its fees are too variable.

Enter the Altcoin

Bitcoin's code is totally open source. What's to stop someone from just copying the code and then starting their own version of Bitcoin?

Nothing!

So that's exactly what developers and marketers have been trying to do, almost from the inception of Bitcoin. Let's do a little tour of recent Altcoins, and see what they have to offer.

Solana: Faster & cheaper than Bitcoin

Launched in 2020 by expert developers and marketers Anatoly Yakovenko and Raj Gokal, the Solana blockchain is fast. Blocks are written every 400 milliseconds. This is more than 1200x faster than Bitcoin. This means, if you send a payment, it will likely be confirmed within seconds.

Not only that, but fees on the Solana network are extremely low. Typically, transactions cost less than half a cent!

This sounds great. But here's the rub: the Solana blockchain is not decentralized, and it is not reliable. The vast majority of Solana nodes are run by the same people who own most of the Solana coin that has been printed: The original founders and marketers of the coin.

This detail becomes apparent every few months, when the Solana blockchain stops working. Those of us who follow these things are well-used to headlines like this:

The marketers of Solana even provide a centrally-hosted status page, similar to one that might be run by a traditional hosting company, like AWS, Heroku, or Digital Ocean:

For a system that goes down a lot, and then has to be manually rebooted by a small team of engineers, a status page like this is certainly helpful.

But it shows us that the Solana network is not resilient or decentralized.

If, for example, a large company, or a national government, wanted to shut down Solana, it would be very easy to do so: A successful lawsuit against Solana's marketing and executive team would suffice to kill the project and shut down all the nodes.

It might not even be that hard: Simply the threat of a lawsuit might be enough to convince the founders and marketers to quickly sell all their coins and shut down their nodes.

Solana is essentially offering hosted a IT service, similar to a database.

But when compared to mainstream database software, for example well-established open source packages like Postgres, or MySQL, Solana also doesn't look so great.

Postgres and MySQL can be easily hosted by anyone, anywhere, in any data center, without permission. They are also much higher-performance than Solana. Database engines can respond to queries with five or ten milliseconds, and, after you set up the software, each query is free, instead of paying per query, as is necessary with Solana.

So although Solana is "fast", and Solana is "cheap", the fact that it is centralized database software, masquerading as a currency, renders it unsuitable as a medium of exchange, and therefore, Solana cannot solve our problem.

EOS: An example of founder risk

We've seen that Bitcoin was created by a person operating under the name "Satoshi Nakamoto". Nobody knows who this person is, or, if anyone does know, they're staying quiet about it.

Satoshi mined the first Bitcoins, and, according to most analyses, those Bitcoins have never been moved or sold, and are simply sitting, unspent, on the blockchain. It's kind of like a nerd's version of the "Immaculate Conception."

Altcoins are different. Typically, their lifecycle closely matches the lifecycle of most other technology companies:

- Smart and ambitious founder comes up with an appealing idea.

- Investors agree that the idea is good.

- Investors shower money on founder.

- Founder uses money to further develop idea.

- Founder uses money to market idea to the public.

- Founder and investors "exit" by selling majority of company to the public.

This system works great for, say, a food delivery service, or a software business.

After the "exit", then professional managers can run the company, and the public can own shares in the company, and the company can keep growing and providing value.

But in the world of currencies, the "exit" stage is problematic. Really problematic.

As far as we know, Satoshi Nakamoto never had an "exit" from Bitcoin.

Let's look at EOS, a now long-forgotten altcoin, which everyone was excited about back in 2017.

Started by a clever marketing team led by Daniel Larimer and Brendan Blumer in 2017, EOS promised a "smart contract platform" which be faster than Bitcoin, with lower fees (kind of like Solana, actually.)

Like other smart founders, Blumer and Larimer registered a corporate entity in the Cayman Islands. They began raising money from investors. They spent huge sums on marketing, even buying billboards in New York's Times Square.

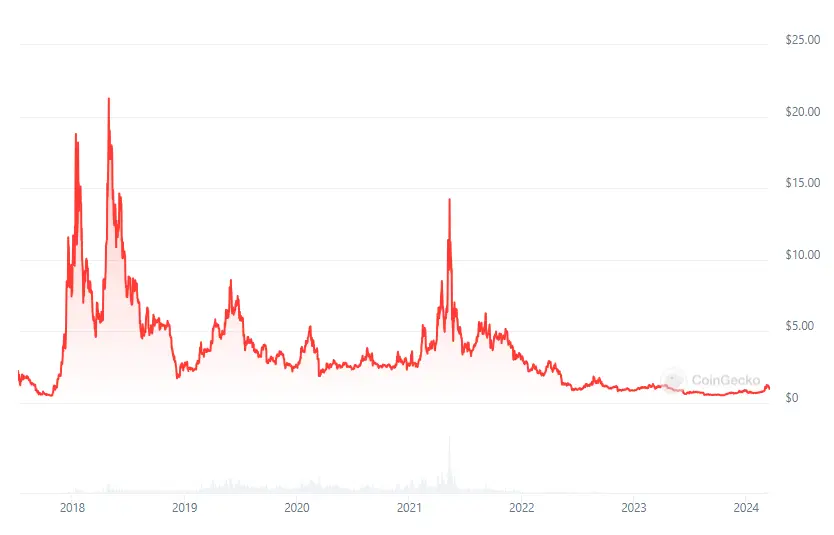

Retail investors started buying EOS Tokens, and the price quickly shot up.

But then the founders and investors looked for their "exit", and sold their EOS tokens near the top of the market. This is what happened.

The price of EOS peaked around the time the founders and investors sold, in 2018. The price then gradually declined.

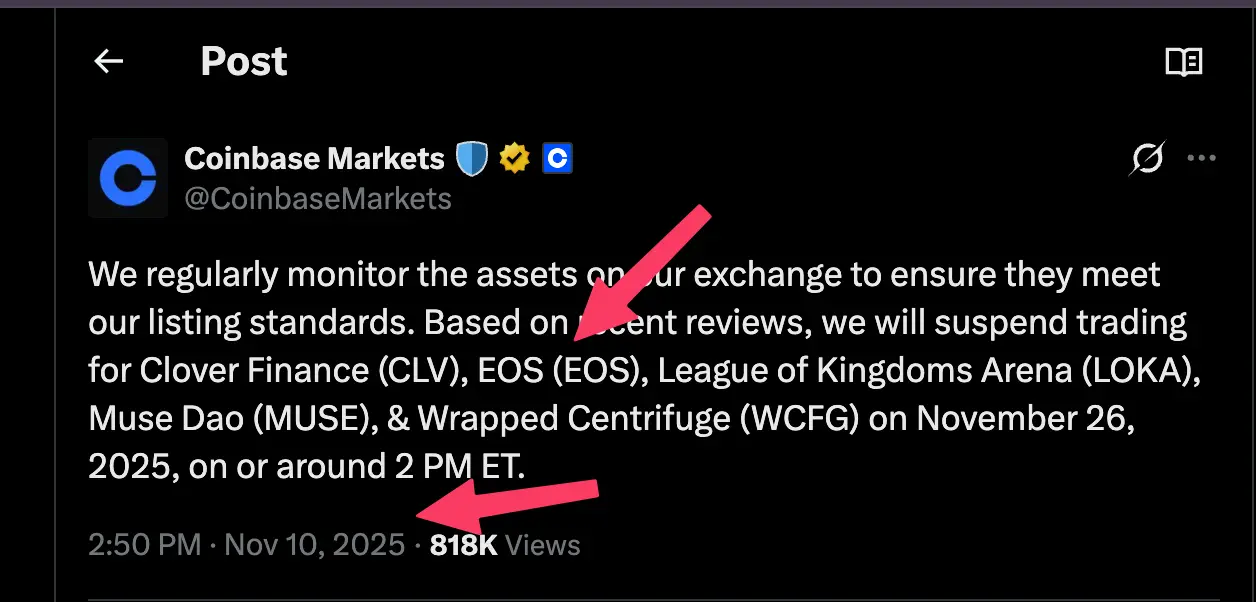

Finally, in November 2025, Coinbase delisted EOS entirely, as the marketing team had long-since sold all their tokens, and there was no demand from retail investors.

"Founder risk": You are likely to buying from the founders, as they are selling

Founders and early investors in Altcoins almost always keep a majority of the coins for themselves, and then inevitably try to sell their shares before retail investors, so they can realize a profitable "exit".

This makes Altcoins a dubious medium of exchange, one that is very unlikely to ever replace credit cards and banks.

No matter what an Altcoin promises in terms of technological or usability advantages over Bitcoin, there is always the problem that the founders and marketers can front-run retail investors, sell their shares, make a huge profit, and then the token becomes worthless.

Altcoins are an incredible way to make money

Let's back up and talk about the "crypto" business, as a whole.

The giant fortunes in "crypto" have all been made with Altcoins.

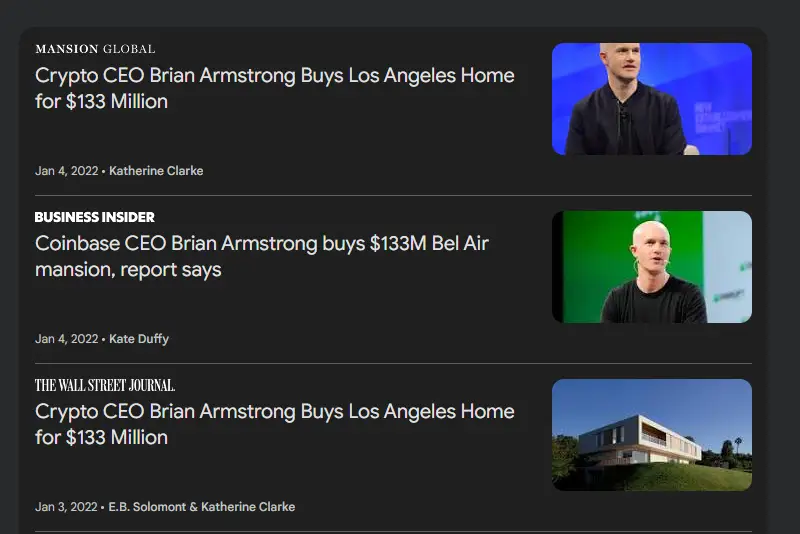

You may have heard about the founder of Coinbase, Brian Armstrong, who bought a house in Los Angeles for $133 million, following the 2021 bull run in digital assets.

Brian didn't make this money from Bitcoin.

In fact, most companies and individuals that have tried to "make money" from Bitcoin have failed. (Except those who have simply bought and held it.)

Brian made this money from Altcoins. Brian works alongside founders and marketers of Altcoins. His company coordinates with marketing teams, and adds new tokens to the Coinbase market so retail investors can buy them.

Typically these coins will stay on Coinbase for a few months or years, until the founding team is able to sell all of their tokens, and then when demand dries up, the token is removed from Coinbase.

There are enormous profits to be made from this model, and there are millions of people who, often many times over, can be tricked into falling for this very simple scheme.

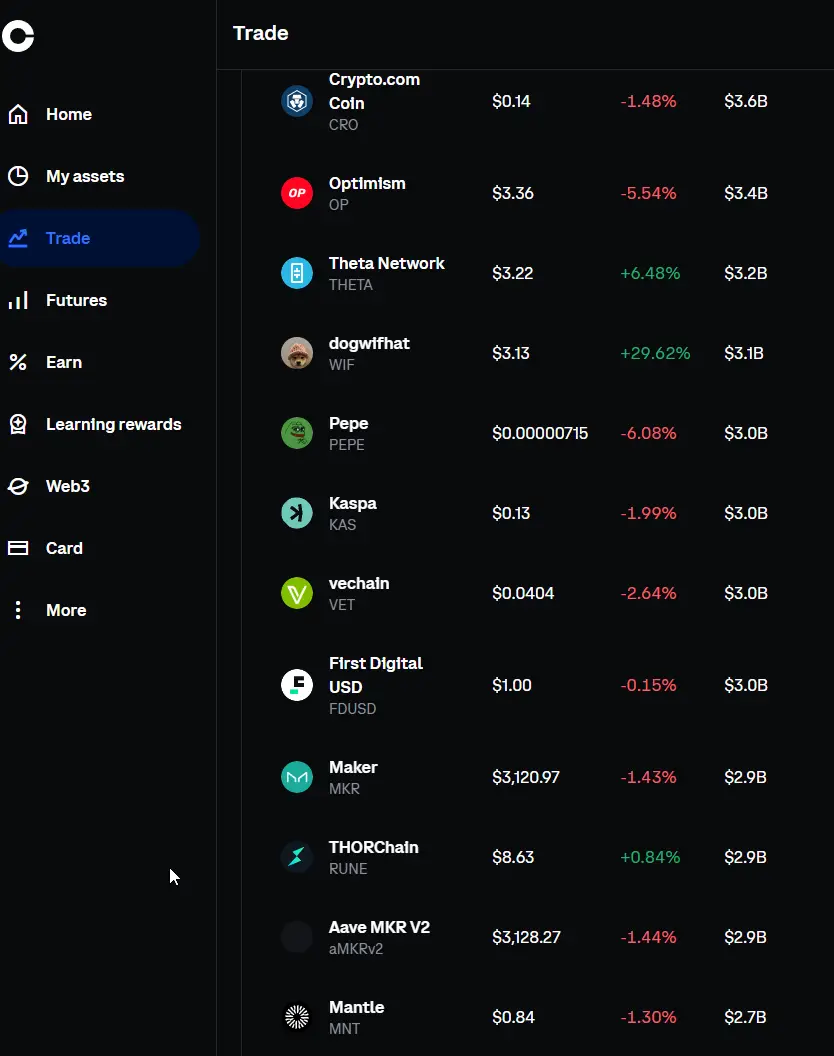

If you get a Coinbase account, and log in, you will find that the platform discourages you from buying Bitcoin, and instead continually offers new and exciting Altcoins.

These offerings are always changing, but one thing stays the same: Coinbase makes money by enabling the founders and marketers of these tokens to "pump" prices up, and then "dump" the tokens as retail investor demand is peaking, just before the prices crash.

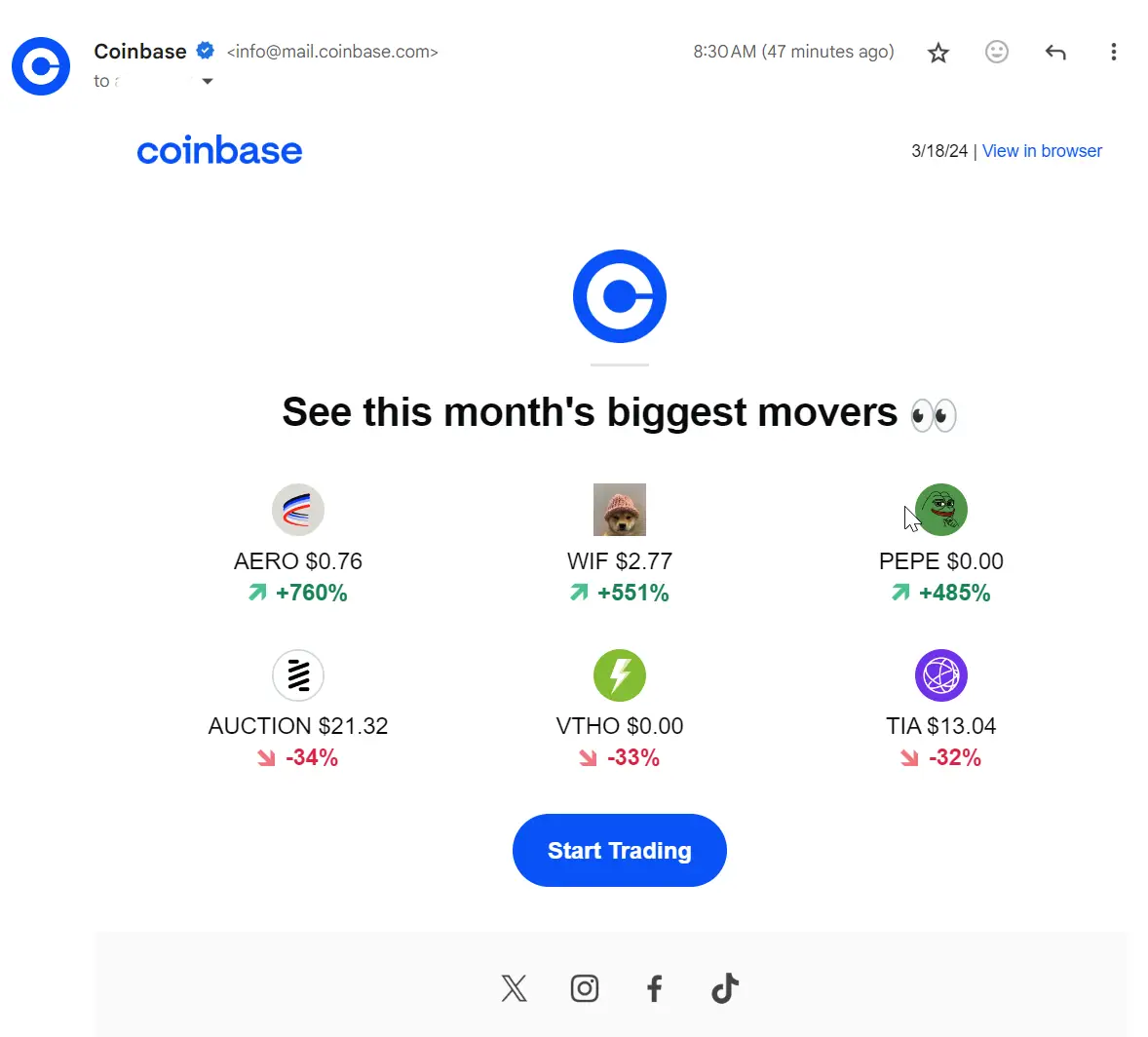

Hilariously, just minutes after I logged into Coinbase to make this screenshot, Coinbase sent me a marketing email. Here is a screenshot of the marketing email:

Coinbase is well-aware that all of these tokens will be worthless in a matter of months. By encouraging you to buy and trade them as much as possible, they enrich themselves and the marketing teams who created them.

Altcoins work well, actually very well, as gambling tokens. In fact, they probably work better for gambling than most of the older gambling technology: casinos, sports betting, lotteries, horse races etc.

But exactly because they are best suited for gambling, they would be a terrible replacement for credit cards: Nobody is going to pay with a medium that can change in value by 1000x in either direction, at any moment.

Altcoins are legally risky.

As it turns out, governments around the world have figured out that companies like Coinbase are running huge and extremely profitable gambling casinos, and they are trying to stop them.

In the United States, the Securities and Exchange Commission (the SEC), a federal agency, has been battling Coinbase and other Altcoin marketers in court.

No one knows what the final outcome of these lawsuits will be, but certainly, if we are looking for a medium of exchange to replace credit cards, none of these tokens will be a great fit.

But aren't governments trying to ban Bitcoin, too?

Yes, some governments, especially totalitarian governments, would very much like to ban Bitcoin, because it might soon threaten their ability to control their people's financial activity.

And even in democracies like the United States, As we saw in The problem with banks, governments often work hand-in-hand with banks to keep the risky "fractional reserve" system running. The Government's support for this (sketchy and unreliable) system is incredibly valuable to banks, so banks tend to be major contributors to political campaigns. Therefore there is a lot of incentive for politicians to take public stands against Bitcoin.

But except in non-free societies (Russia, China, North Korea), governments actually have limited tools to ban Bitcoin. The exchange of Bitcoin is just the exchange of information, and in most free societies, courts impose strict limits on the government's ability to restrict the flow of information.

In the United States, an outright ban on Bitcoin has never been tested in the courts, but most observers now believe that, were it to be tested, for example in a case brought to the U.S. Supreme Court, that the Court would find that the use of Bitcoin is protected by the First Amendment to the U.S. Constitution, which guarantees the right to free speech.

The situation with Altcoins is a little bit different. Since these tokens are created and marketed by individual, for-profit companies, they fall under something called "Securities Law."

A full discussion of these laws is outside the scope of this documentation. But let's put it simply: If you start a company, and wish that company's shares to be listed on a stock exchange, like the New York Stock Exchange, you have to follow a complicated set of rules, hire a huge number of expensive lawyers, and undergo an expensive SEC approval process.

Altcoin marketers like Coinbase, Kraken, Binance, Solana, and FTX have refused to follow the SEC's rules with respect to stock offerings. That is why these companies are all are being sued by the SEC, and the future viability of their business model is under some doubt.

Ethereum: success leads to high fees

One of the longest-lived Altcoins, invented in 2013, and marketed extensively by the New York company ConsenSys, is called Ethereum.

Whereas almost nobody believes that Solana or EOS are decentralized, there is some legitimate debate regarding the status of Ethereum.

If a government wanted to shut down Ethereum, that government could sue ConsenSys, and probably force them to stop advertising Ethereum, but there are enough Ethereum nodes running on enough computers, in enough different countries in the world, that this might not be sufficient to take down the system.

What is interesting about Ethereum is what it has taught us about the dynamics of transaction fees on blockchains.

While most Ethereum was retained by the founders of the coin, and early investors, these individuals have been gradually selling their tokens to members of the public, and usage of the blockchain has increased.

At first, transactions on the Ethereum chain were cheap, and also a bit faster than Bitcoin.

But, by 2017, a curious phenomenon was apparent: Ethereum became so successful that the network started to exhibit the same problems faced by Bitcoin. There was so much competition for transaction space in the Ethereum blockchain that Ethereum transaction fees started to increase.

This was a useful lesson. It seems that a new blockchain will always have low fees, due to a lack of usage.

But, at some point, if people actually use the token a lot, competition for block space will increase, and users will then run into the same problem encountered by Bitcoin users: unpredictable and sometimes high fees.

So it doesn't seem that switching from Bitcoin to a different currency will solve our issue. An Altcoin is not the credit card replacement that we are looking for.

Maybe what we need is: A Lightning Network.